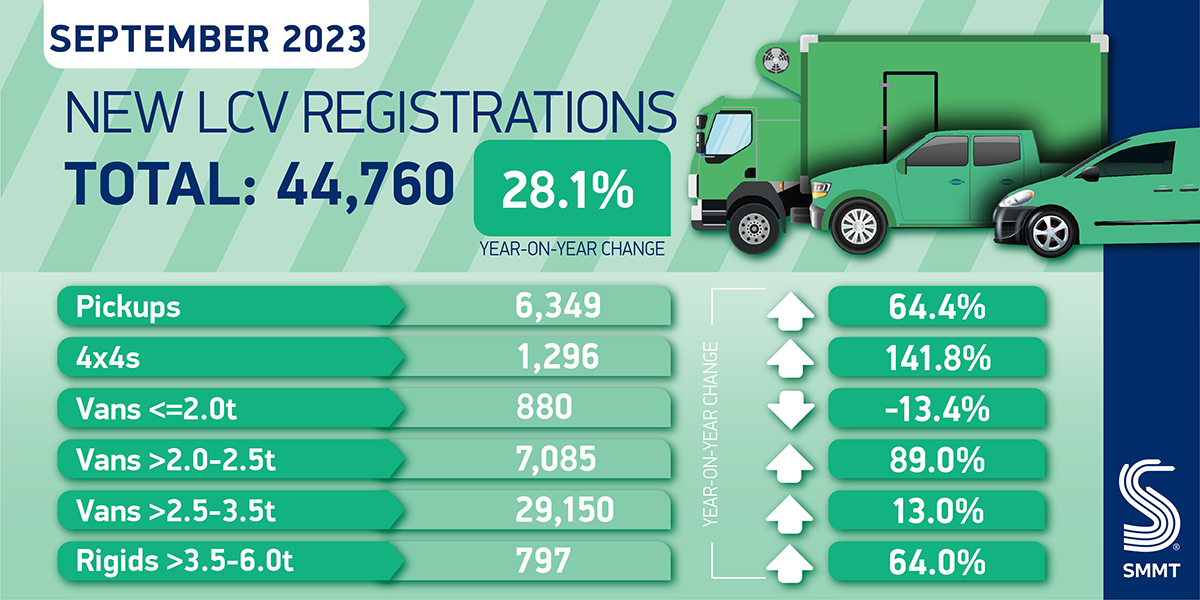

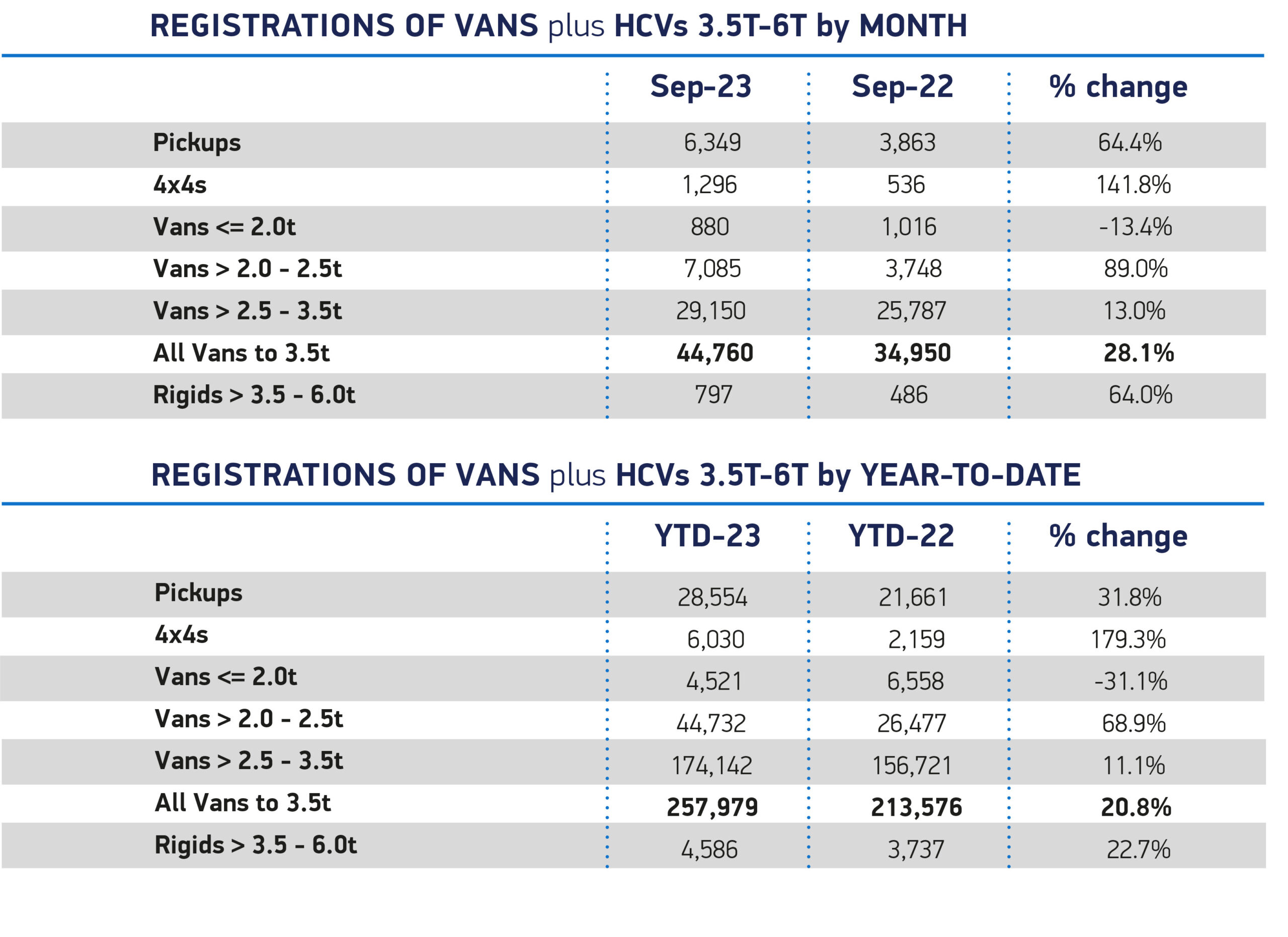

Britain’s new light commercial vehicle (LCV) market grew for the ninth month in a row in September, up 28.1% with 44,760 of the latest vans, pickups and 4x4s joining UK roads, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). One of the most popular months for new van purchases, plate change September saw robust demand round off 20.8% growth in the year to date, with 257,979 units registered in the first nine months.

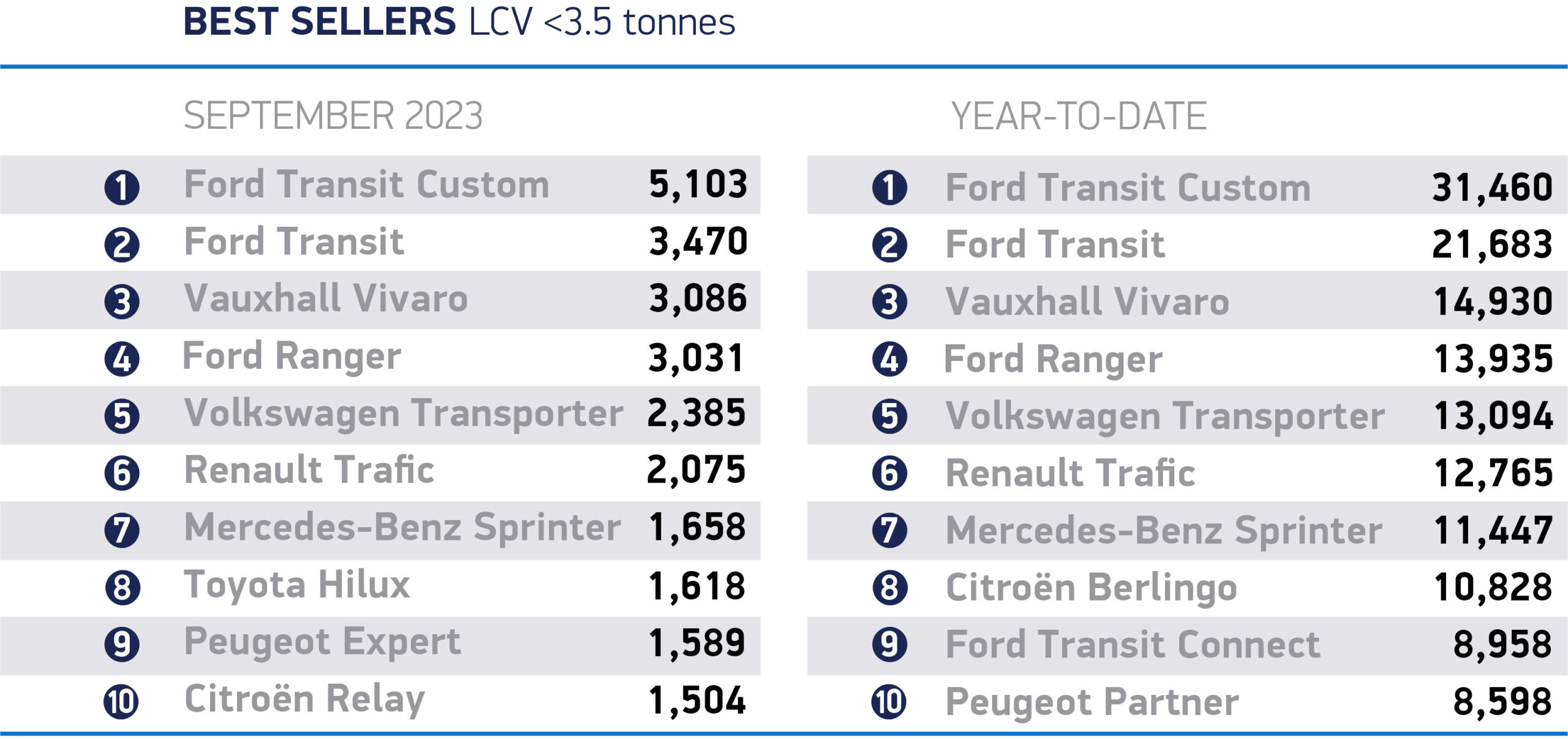

Operators continue to opt for payload and fuel efficiencies, with the largest vans – weighing greater than 2.5 tonnes to 3.5 tonnes – remaining the biggest market for new buyers in September, rising 13.0% to 29,150 units. Medium-sized vans also saw significant growth, up 89.0% to 7,085 units, while demand for pickups and 4x4s increased by 64.4% and 141.8% respectively. Deliveries of the smallest vans, meanwhile, fell -13.4% to 880 units.

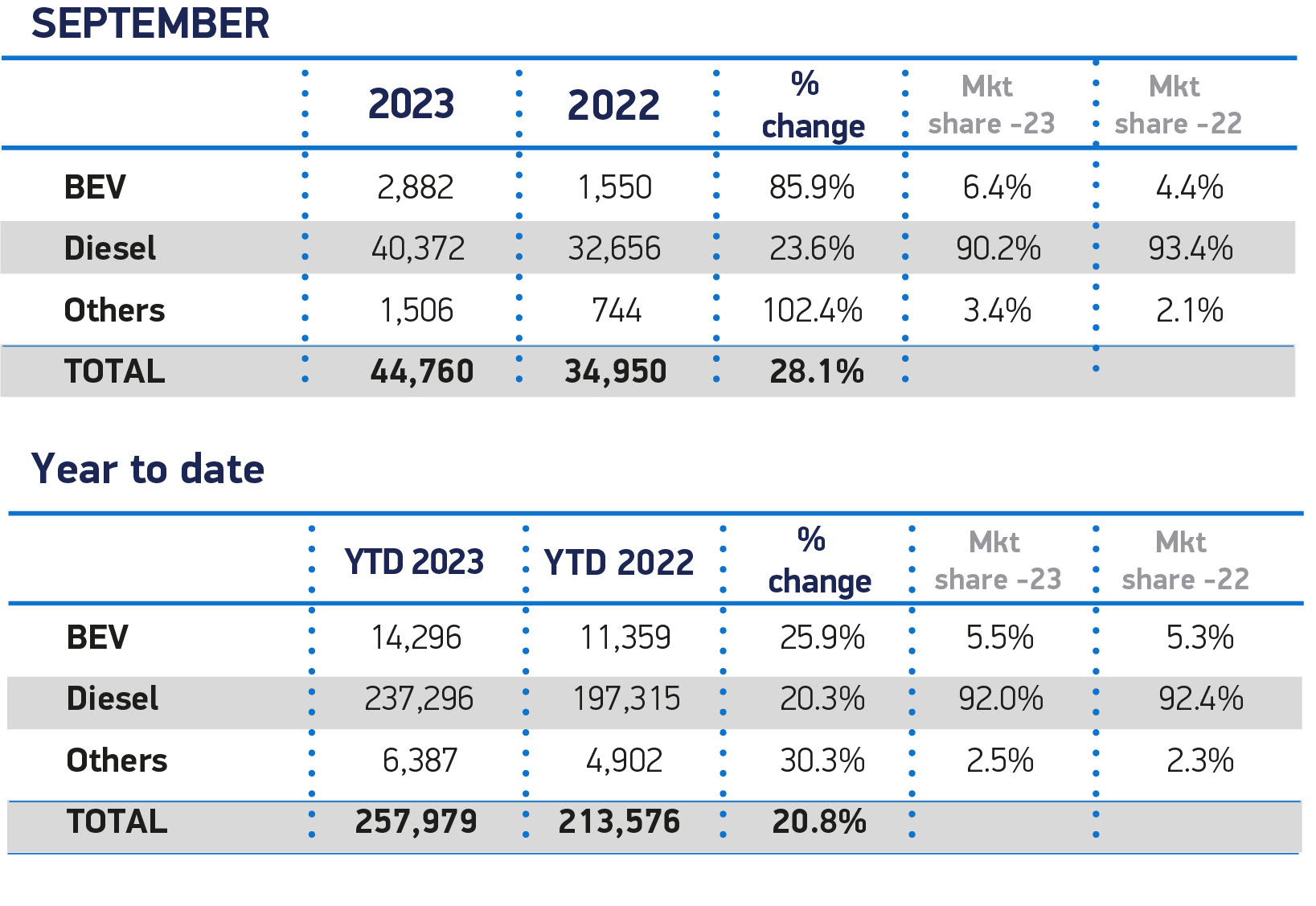

The Plug-in Van Grant, competitive running costs and increasing model choice continued to boost demand for battery electric vans (BEVs) in September, with deliveries up 85.9% to 2,882 units – accounting for one in 16 new vans registered in the month. With 25 zero emission van models now available in the UK, these vehicles already carry out a wide range of roles for operators, from local businesses to some of the country’s largest organisations.

As a result, a UK record 14,296 electric vans have been registered since January, commanding 5.5% of the overall market. As manufacturers now face new zero emission van sales quotas starting at 10% in January, however, there is a clear need for a national plan that gives more van operators the confidence to make net zero investments. In particular, public charging infrastructure must be suitable for vans of all shapes and sizes so that van drivers – like their passenger car counterparts – can realise the full benefits of zero emission motoring.

Mike Hawes, SMMT Chief Executive, said, “Vans are irreplaceable workhorses that keep Britain on the move, so a bumper September capping nine months of growing fleet renewal is good news for the economy, the environment and society. Decarbonising this sector is fundamental to the wider net zero transition and, as vans are business critical, urgent measures are needed to grow operator confidence to invest now, in 2024 and beyond. In particular, the specific needs of van operators must be considered when planning public charging strategies.”

“Business confidence and a drive to update van fleets to comply with ever increasing low-emission-zones, has contributed significantly to the increase in LCV registrations for this plate-change month,” said Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK commenting on the latest SMMT’s new passenger van registration figures.

In September, Light Commercial Vehicle (LCV) dealers registered a total of 44,760 new vans and light commercials, an increase of 28.1%. This is the ninth consecutive month of registration growth. Year-to-date figures reveal 257,979 new LCVs are on the road this year, an increase of 20.8%.

The heavier sectors of LCVs have improved substantially, with 2.0-2.5t sized vans rising to 7,085 units from 3,748 units, an 89% increase. This is unsurprising, with many manufacturers encouraged to increase the gross plated weight (GVW) of their LCVs, moving into the mid sector of 2.0 – 2.5t. The heavier, and most popular sized vans (2.5-3.5t) often purchased by fleets for online deliveries has increased to 29,150 units from 34,950 units, a 13% rise.

Although a smaller market, 4×4 experienced strong growth year-on-year, with 1,296 units on the road compared to last year’s 536 units, a 141.8% increase.

September saw an increase in the number of battery electric commercials registered, up a staggering 85.9% to 2,882 units. Whilst the volume for EV vans has increased to 14,296 units this year, it still only represents 5.5% of the market, a 0.2% increase from this time last year.

Sue Robinson added: “In recent discussions with van operators, it is the sheer price difference between diesel and electric light commercial that is holding back electric van adoption. On average, EV light commercials are a third more expensive than their diesel equivalent; it is therefore crucial that government intervenes with attractive price incentives to support the businesses and motorists in making their necessary switch to electric.”